Every year new brokers promise to “redefine trading,” but the real test is how those promises translate into practice. Gracex Reviews across forums and analytical sites show a mix of praise and skepticism, so in 2025 it is worth breaking down whether the broker truly delivers. This article examines regulation, accounts, platforms, services, and reputation to answer the question raised in the title.

Legal Framework and Reliability

Gracex operates under the supervision of the Union of Comoros (Anjouan) with license number L15817/GL. Client deposits are kept in segregated accounts, and the company follows international KYC and AML standards. For traders, this means identity verification, compliance checks, and a certain degree of operational transparency. This regulatory status is often mentioned positively in Gracex Reviews as a minimum safeguard, though some users wish for oversight from larger jurisdictions.

In other words, the promise of safety is backed by documented rules — a first point where reviews match reality.

Account Types Viewed Through Trader Profiles

The broker offers four main accounts, each adapted to different needs:

- FREE — up to $500 balance, no commissions, aimed at new traders testing strategies without risk of ongoing costs.

- ZERO — requires a $100 monthly fee, but in exchange provides raw spreads from 0.0 pips, suited to active traders seeking execution speed.

- FIX — fixed spreads from 3 points, attractive to conservative traders who value predictability.

- CENT — $10 per lot, tailored for beginners learning money management with micro-positions.

According to user reviews, this structure resonates well with different profiles: some highlight the FREE account as a low-entry path, while professionals prefer ZERO for its raw pricing. This echoes the title’s question — reviews often align with what is actually provided.

Trading Conditions: Execution and Fees

One of the most cited strengths in Gracex Reviews is the cost structure: spreads starting from 0.00 pips, 0% trade commission, no swaps, and pure STP execution. By avoiding a dealing desk model, the broker reduces conflicts of interest. Traders report stable fills during active hours, though a minority mention slippage in volatile news events — a standard challenge in STP environments.

Evaluation by criteria shows: execution quality — mostly stable; stability — reliable on MT5 infrastructure; fees — highly competitive compared to peers. Here again, reviews correspond well to the broker’s declared conditions.

Technology and Platform Choice

Gracex provides access to MetaTrader 5, available as WebTrader, mobile apps for Android/iOS, and desktop. The platform supports algorithmic robots, advanced indicators, and deep analytics. Traders emphasize in reviews that the broker does not restrict automated strategies, which makes it attractive for those testing EAs. This is another point where promises of “tech-driven solutions” are reflected in practice.

Services Beyond Execution

The broker expands beyond classic trading by offering:

- Copy Trading — auto-replication of successful traders’ positions.

- Social Trading — visibility into community trends and strategies.

- PAMM accounts — managed solutions where professionals trade on behalf of investors.

- Bonuses, education, and analytics — structured materials for different levels of experience.

For traders with limited time or knowledge, these services represent an accessible entry. Reviews highlight Copy Trading and PAMM as popular choices among beginners. Here, reality confirms the marketing promise of “inclusive participation.”

Markets Coverage

Gracex offers a wide spectrum of assets: Forex majors and exotics, stock indices, precious metals, energy commodities, cryptocurrencies, and regional CFDs split by continent. This diversity provides flexibility for portfolio strategies. Reviews often note the availability of crypto assets as a plus, while some conservative traders prefer sticking to metals and FX majors. In both cases, the offering covers expectations.

Awards and Industry Recognition

In 2024, Gracex was named The Fastest Growing Broker by the World Financial Award and received The Best Customer Support title from the Forex Brokers Association. While awards can be marketing tools, many reviews confirm responsive support — especially via live chat. This strengthens the link between advertised recognition and real user experience.

Reputation Breakdown: Strengths and Weaknesses

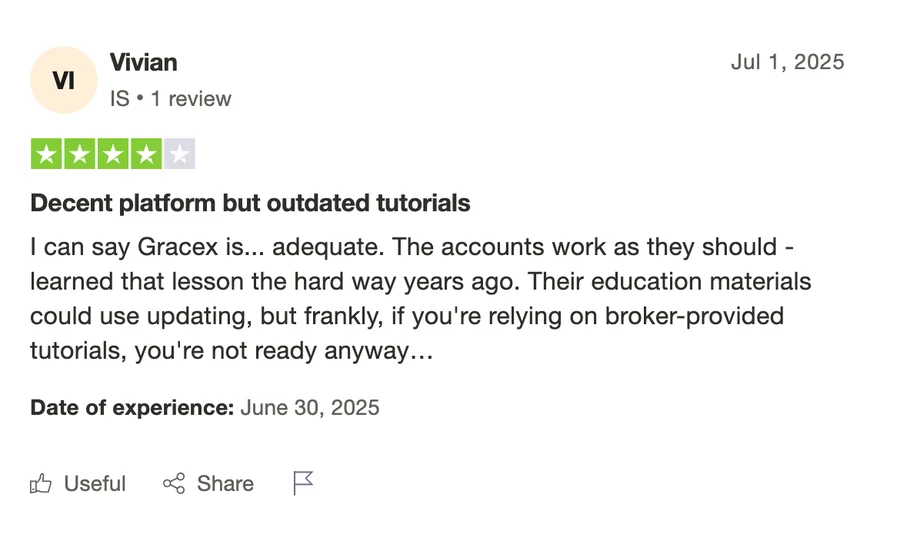

Sources of reviews include Trustpilot, specialized broker ratings, and trading forums. Recurring strengths mentioned are competitive spreads, user-friendly MT5, and helpful support. Weaknesses revolve around regulatory jurisdiction (some users prefer EU/UK licensing) and occasional delays in account verification. Importantly, no widespread claims of fund withdrawal issues appear in 2025 reviews, which adds credibility.

Final Verdict: Do Reviews Reflect Reality?

After walking through legal status, accounts, fees, platforms, services, and user opinions, the verdict is nuanced. For most evaluation criteria — execution, stability, and pricing — Gracex delivers as promised. Where skepticism remains is jurisdiction and the need for even more robust global regulation. Thus, the answer to the title’s question is: yes, Gracex Reviews largely reflect reality in 2025, with caveats depending on trader expectations.

Checklist for Readers

- Check your profile: FREE and CENT for beginners, ZERO and FIX for experienced traders.

- Confirm your ID early to avoid verification delays.

- Use MT5 demo before committing to a paid account.

- Compare fees with your current broker to see potential savings.

- Decide whether regulation level matches your personal risk tolerance.

Following this checklist helps answer for yourself whether Gracex’s promises align with reality — echoing the core of the Gracex Reviews 2025 discussion.