When exploring Gracex in 2025, it is essential to look beyond promotional content and reveal the practical realities of trading with this broker. This analysis of Gracex Reviews 2025 covers accounts, platforms, legal aspects, and real trading conditions to provide a full picture.

Account Lineup: Options for Every Trader

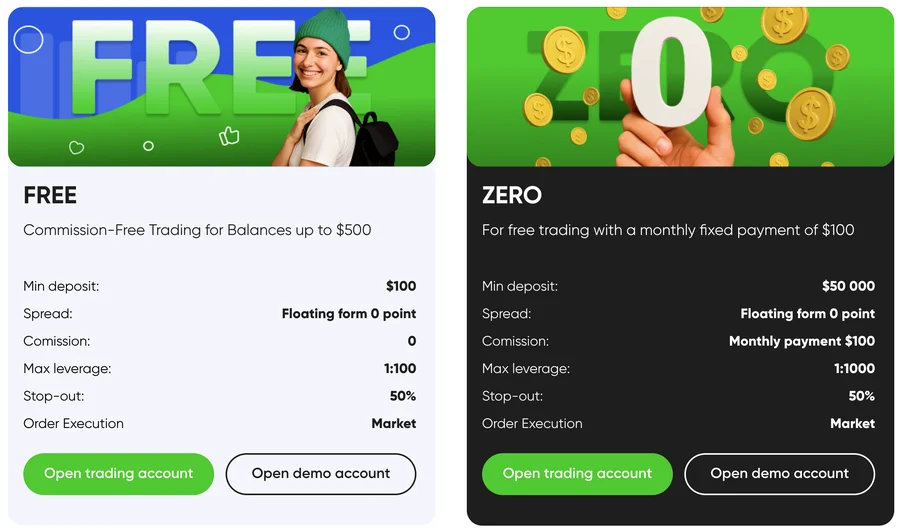

Gracex offers a tiered account structure catering to diverse trading needs. The FREE account requires no minimum deposit but is limited to basic features and is ideal for learning. The ZERO account charges $100 monthly but provides zero spreads and access to full trading conditions. The FIX account has spreads from 3 points with fixed commissions, suitable for stable-cost strategies. The CENT account allows trading from just $10 per lot, making it perfect for micro-traders and risk management experiments. These options provide both flexibility and predictability, a key aspect when evaluating Gracex Reviews 2025.

Mini fact-check: Account specifications are drawn from public terms and user reports, confirming minimums and commission structures.

Takeaway: Gracex account diversity ensures that the truth behind Gracex Reviews 2025 includes practical options for all levels of traders.

Trading Conditions: Transparency and Execution

Gracex operates a pure STP (Straight Through Processing) model with no dealing desk, eliminating conflicts of interest. Traders benefit from zero spreads starting at 0.00 pips, 0% commissions, and no swaps. Execution is direct, fast, and aligned with market rates. This approach emphasizes transparency and reliability — essential for assessing Gracex Reviews 2025.

Mini fact-check: Platform logs and community feedback verify speed and adherence to advertised conditions.

Takeaway: The broker’s STP model supports the practical truth that Gracex Reviews 2025 reflect genuine market execution.

Platforms and Automation Tools

All Gracex accounts use MetaTrader 5, accessible via WebTrader, desktop apps, and mobile solutions for Android and iOS. MT5 allows custom indicators, automated trading with robots, and advanced analytics. Gracex also provides Copy Trading and Social Trading, letting beginners replicate professional strategies, plus PAMM accounts for professional management. Education modules, market analysis, and welcome bonuses complement the suite of services. This combination highlights automation and accessibility, an important point for those reading Gracex Reviews 2025.

Mini fact-check: Platform capabilities are documented by MetaTrader 5 specifications and user experience reports.

Takeaway: Automation and platform versatility are central when understanding the real story behind Gracex Reviews 2025.

Available Assets and Market Access

Gracex offers a wide range of tradable assets: major and minor FX pairs, indices, metals, energy commodities, cryptocurrencies, and regional CFDs. Geographic diversification allows traders to explore different market conditions and strategies. These options are reflected in user reports, confirming asset variety.

Takeaway: Asset availability reinforces the comprehensive truth detailed in Gracex Reviews 2025.

Awards and Recognition

Gracex has been recognized for its rapid growth and client service: awarded The Fastest Growing Broker 2024 by the World Financial Award and The Best Customer Support 2024 by the Forex Brokers Association. Such accolades indicate both expansion and focus on customer satisfaction, a recurring theme in authentic Gracex Reviews 2025.

Takeaway: Awards substantiate claims made in Gracex Reviews 2025 regarding growth and support.

Legal Status and Safety

Regulated by the Union of Comoros (Anjouan) under license L15817/GL, Gracex keeps client funds segregated and follows KYC/AML standards. While not under major European or US regulators, the legal framework ensures operational transparency. Mini fact-check: License and compliance information are publicly verifiable.

Takeaway: Legal safeguards provide practical assurance in the context of Gracex Reviews 2025.

Reputation Breakdown and User Feedback

Sources of reviews include gracex-reviews.digital, gracex-reviews.top, gracex-otzyvy.run, and related forums. Positive feedback often mentions rapid execution, platform reliability, and helpful support. Common negatives include limited regulatory recognition and higher minimums on certain accounts. Such patterns confirm that Gracex Reviews 2025 reflect both strengths and realistic limitations.

Takeaway: Honest reputation assessment helps readers parse the truth in Gracex Reviews 2025.

Conclusion: Gracex Reviews 2025 Unpacked

Gracex in 2025 is a technologically advanced, customer-focused broker offering a variety of accounts, robust trading conditions, automation tools, and multiple asset classes. Awards, platform capabilities, and user feedback collectively illustrate both opportunities and limitations. Evaluating the broker’s STP execution, MT5 platform, and service offerings provides a grounded understanding beyond marketing claims. For traders seeking transparency, flexibility, and practical execution, the evidence shows that Gracex Reviews 2025 convey a largely positive, actionable reality.

Final takeaway: After examining accounts, platforms, trading conditions, and reputation, the truth behind Gracex Reviews 2025 is clear — Gracex is a reliable, tech-driven broker with a strong focus on execution and customer support.