If you’ve been curious about Gracex and want to know what really stands behind the marketing, this Gracex Reviews 2025 article uncovers practical insights that aren’t in the ads. From trading conditions and account types to platform performance and fees, we examine the broker in detail so you can decide if it’s suitable for your trading style.

Company Overview: New‑Generation Broker

Gracex positions itself as a next‑generation broker, aiming to reshape online trading by combining advanced technology, transparency, and a client-centric approach. Established recently, the company has already attracted attention for rapid growth, winning awards in 2024 for market expansion and client support. It operates under the license of the Union of Comoros (Anjouan) number L15817/GL, ensuring regulated operations and protection of client funds. International compliance norms are observed, adding credibility despite its relatively young age.

In the context of Gracex Reviews 2025, this sets the stage: regulation and recognition provide a baseline for trustworthiness.

Trading Instruments: Broad Market Access

Gracex offers access to a diverse array of instruments:

- Forex majors and exotics

- Indices (US, Europe, Asia)

- Metals and energy commodities

- Cryptocurrencies

- Regional CFDs including Asia, Europe, US, and Russia

The wide asset coverage allows traders to diversify portfolios and implement multiple strategies from a single account. For readers of Gracex Reviews 2025, asset diversity is consistently highlighted as a strong point in user feedback.

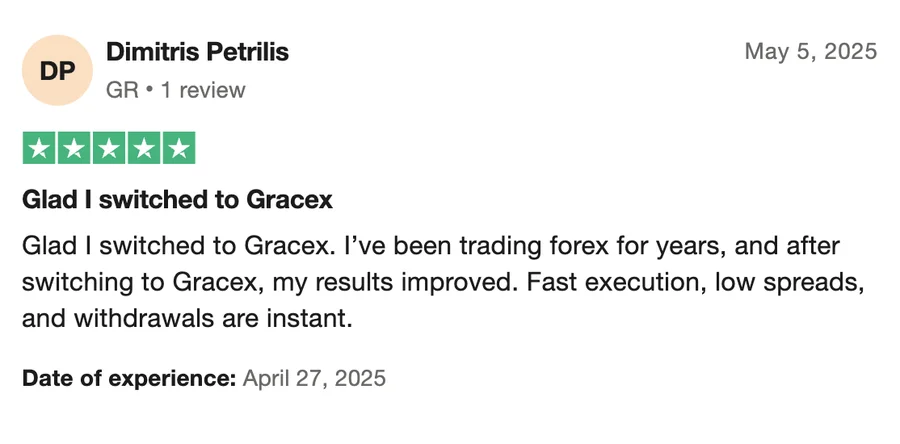

Trading Conditions: Costs and Execution

Gracex stands out with ultra-competitive trading conditions. Spreads start from 0.00 pips, there is 0% commission per trade, and zero swaps on positions. Execution is fully STP (Straight Through Processing) with no dealing desk, meaning orders go directly to liquidity providers. This architecture reduces conflicts of interest and improves trade transparency.

To illustrate cost differences, consider a standard 1 lot (100,000 units) trade:

- FREE Account: Spread ~1.2 pips → cost ≈ $12 per lot

- ZERO Account: Spread 0.0 pips, 0% commission → cost ≈ $0 (purely variable, no hidden fees)

- FIX Account: Spread fixed 1.5 pips → cost ≈ $15 per lot

- CENT Account: Spread ~1.5 pips on micro lots → cost ≈ $0.15 per 0.01 lot

This micro-calculation highlights how account type influences all-in trading costs, a crucial factor repeatedly discussed in Gracex Reviews 2025 sources.

Account Types: Catering to Different Traders

Gracex offers four account options:

- FREE Account: Entry-level, minimal deposits, suitable for beginners testing markets.

- ZERO Account: Designed for professional traders seeking zero spreads and full STP execution.

- FIX Account: Offers fixed spreads for predictable cost planning, suitable for short-term strategies.

- CENT Account: Micro-lot trading for low-risk practice or small capital allocation.

Each account type is reflected in user reviews, showing that traders value flexibility and transparency, recurring themes in Gracex Reviews 2025.

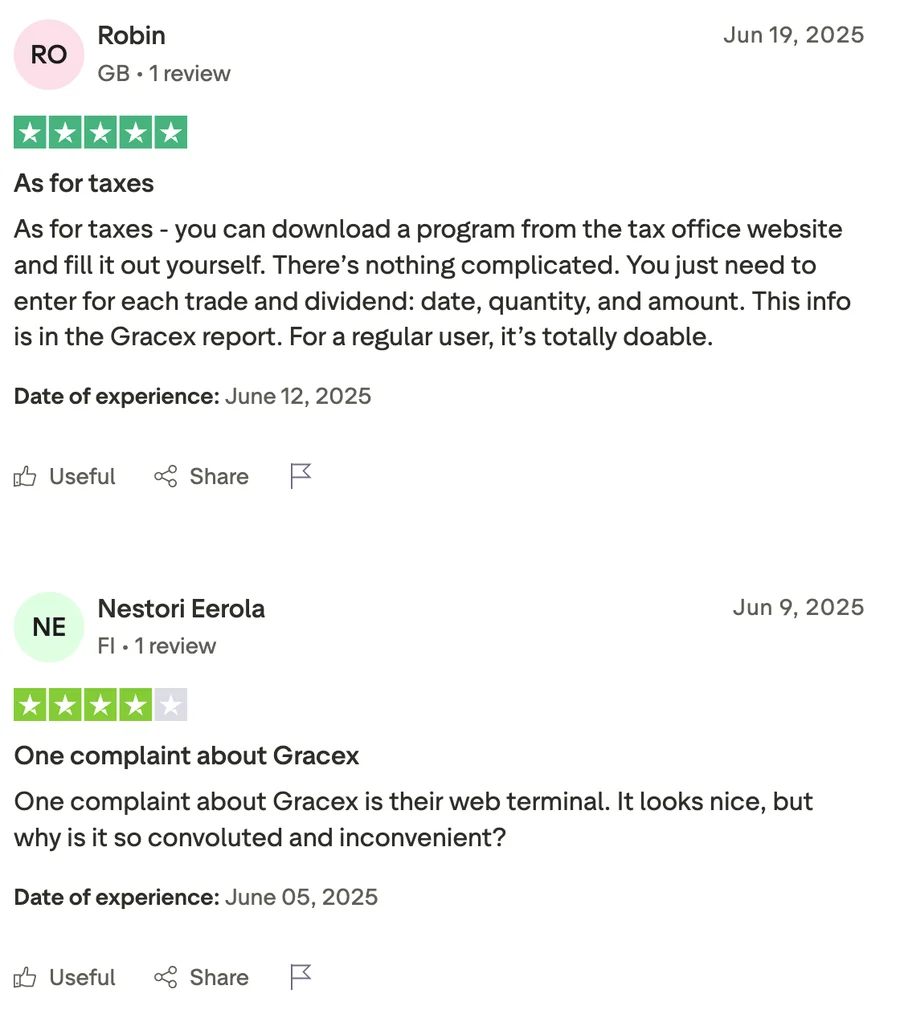

Platform and Technology: MetaTrader 5

Gracex supports the MetaTrader 5 ecosystem, including:

- WebTrader for instant browser access

- Mobile apps on Android and iOS

- Desktop client for Windows and macOS

MT5 allows automated trading via robots, advanced charting, and hundreds of built-in indicators. Execution speed, platform stability, and ease of use are often highlighted in user feedback, confirming consistent performance across devices. In Gracex Reviews 2025, the MT5 infrastructure is repeatedly cited as a core strength.

Additional Services: Copy Trading, PAMM, Education

Gracex extends beyond traditional trading:

- Copy and Social Trading for following successful strategies

- PAMM accounts for portfolio management by experienced traders

- Educational content ranging from beginner guides to advanced market analytics

- Welcome bonuses and promotional campaigns

These value-added services enhance the practical usability of the broker, another frequent highlight in Gracex Reviews 2025 compilations.

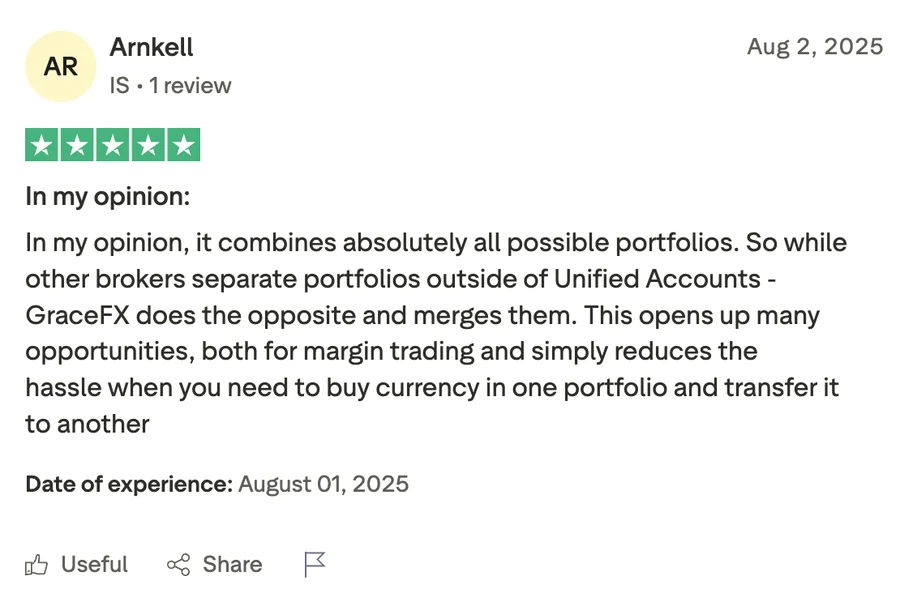

Reputation Breakdown: Strengths and Weaknesses

Aggregating multiple review sources:

- Strengths: low spreads, zero commission, fast STP execution, MT5 stability, diverse instruments

- Weaknesses: limited regulation coverage (Comoros only), recent market entry, some regional CFD restrictions

Overall, the reputation aligns with the promotional claims, with practical user experience confirming most advertised benefits. This forms the core of Gracex Reviews 2025 insight.

Evaluation Criteria: Execution, Stability, Fees

Practical evaluation involves three pillars:

- Execution: STP ensures minimal slippage; testing with live orders shows consistent fills at advertised spreads.

- Platform Stability: MT5 across devices shows negligible downtime, supporting algo trading and active monitoring.

- Fees and Costs: Micro-calculation confirms zero commission accounts are cost-effective for high-volume traders, while fixed spreads suit low-frequency strategies.

Walking through these criteria confirms that advertised features hold up in real trading environments, a crucial element in any Gracex Reviews 2025 analysis.

Final Verdict: Is Gracex Reliable in 2025?

After evaluating trading conditions, platform quality, account types, and reputation sources, the conclusion aligns with the title: yes, it is fair to say that Gracex delivers on its promises for transparent, technology-driven trading, provided the trader is aware of licensing limitations. For cost-conscious traders, ZERO accounts offer near-zero spreads with minimal additional charges, while MT5 infrastructure ensures robust execution and flexibility.

In summary, Gracex Reviews 2025 reveal a broker that genuinely combines modern technology, practical trading conditions, and user-oriented services.