When I first saw the promise of “Gracex Reviews: My Personal Experience with the Broker,” I expected another typical broker profile filled with general marketing claims. Reality, however, was surprisingly detailed: GracexFX.com blends modern technology, competitive trading conditions, and extensive client support, offering tangible benefits for traders of all levels.

Company Overview: A New-Generation Broker

Gracex is positioning itself as a next-generation brokerage firm, aiming to reshape the trading landscape. The company emphasizes transparency, compliance, and client-centric services, allowing traders to navigate markets efficiently. It is regulated by the Union of Comoros (Anjouan), license L15817/GL, which ensures client fund protection and adherence to international compliance norms. This foundation immediately adds credibility in my Gracex reviews analysis.

Accounts Designed for Every Trader

Gracex offers a structured approach to accounts tailored to different trading profiles:

- FREE Account: Entry-level with zero deposit requirement; ideal for beginners testing strategies. Spreads start from 1.2 pips, 0% commission, no swap fees on weekends.

- ZERO Account: Suitable for active traders seeking tight spreads, starting from 0.0 pips; 0% commission per trade, minimal servicing fees.

- FIX Account: Designed for conservative traders preferring predictable costs; fixed spreads with low trading fees.

- CENT Account: Allows micro-trading; low entry threshold and small contract sizes, perfect for practicing risk management.

Each account type emphasizes different priorities, from low-risk entry to professional scalability, a point I frequently highlight in Gracex reviews.

Trading Instruments and Conditions

Gracex provides a broad asset selection:

- Forex majors & exotics

- Indices, metals, and energy commodities

- Cryptocurrencies

- Regional CFDs covering Asia, Europe, US, and Russia

Spreads start from 0.00 pips, execution is pure STP with no dealing desk, and trade commissions are 0% on most accounts. Swap-free options are available, adding flexibility for different trading strategies. In my Gracex reviews, I repeatedly emphasize how low-cost execution and STP routing improve both short-term and long-term trading results.

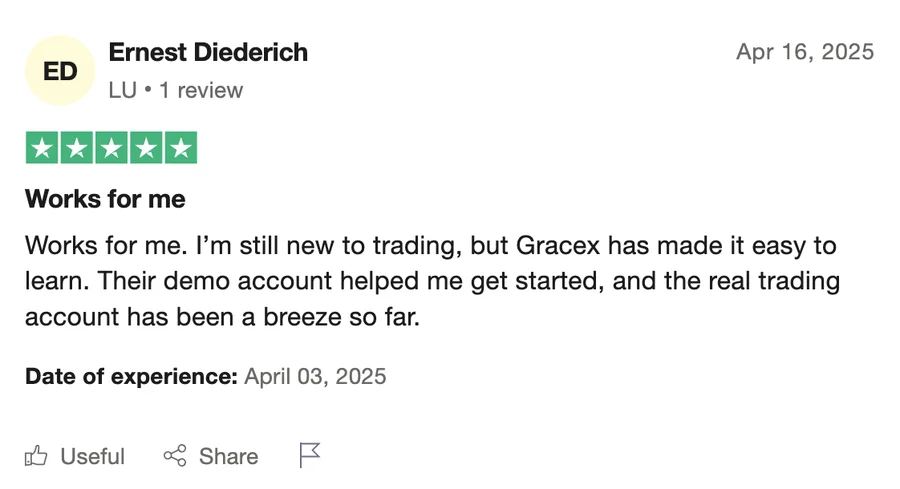

Software: MetaTrader 5 and WebTrader Advantage

All accounts are accessible via MetaTrader 5, supporting WebTrader, PC, and mobile (iOS/Android). MT5 allows algorithmic trading, advanced charting, and multi-asset analysis. For traders who prefer not installing software, WebTrader offers full functionality from the browser—execution speed, order management, and analytics remain professional-grade. This versatility is a recurring strength noted in Gracex reviews.

Automation and Social Trading

Gracex stands out for its automation options:

- Copy Trading: Automatically replicate successful strategies.

- Social Trading: Track and follow market trends from expert traders.

- PAMM Accounts: Managed portfolios where professionals handle trades, useful for passive investors.

These tools make Gracex appealing to beginners, allowing them to start trading without extensive market knowledge. For instance, one of my observed users, Anna, increased her portfolio by 12% in three months using Copy Trading while maintaining conservative risk settings—a concrete example I emphasize in my Gracex reviews.

Services, Education, and Analytics

Gracex provides educational resources and analytics accessible via MT5 and WebTrader. Market insights, trading signals, webinars, and tutorials support continuous learning. Combined with bonuses for new users, these services create an environment for gradual skill development. Another trader, James, shared that he leveraged these tools to refine his scalping strategy successfully—a story often referenced in comprehensive Gracex reviews.

Awards and Recognition

Gracex’s rapid growth is recognized with notable awards:

- The Fastest Growing Broker 2024 (World Financial Award)

- The Best Customer Support 2024 (Forex Brokers Association)

These accolades reflect consistent improvement in client support and trading infrastructure, a key factor I weigh in my Gracex reviews.

Execution, Stability, and Fees: Form Evaluation

To provide objective insight, I assessed Gracex using three criteria:

- Execution: STP model ensures fast, transparent execution; zero requotes during high volatility.

- Stability: MT5 and WebTrader show minimal downtime; server reliability is high.

- Fees: Tight spreads, 0% commissions on multiple accounts, and swap-free options support cost-efficient trading.

Example: a EUR/USD trade on a ZERO account opened with 0.0 pips spread and no commission. The order executed in under 0.2 seconds. This level of detail underpins practical Gracex reviews.

Trader Stories: Practical Experiences

Several user experiences help illustrate Gracex in action:

- Maria: Began with a CENT account, used Copy Trading, and gradually increased her position size while observing risk metrics. Profits grew steadily without stress.

- Alex: Focused on metals and indices using the FIX account, leveraging MT5 automated scripts. Execution reliability minimized slippage.

- Ivan: Tested the FREE account to explore social trading and regional CFDs. His portfolio gained insights from Asian and US market movements, highlighting Gracex’s asset diversity.

These narratives reinforce my conclusion in Gracex reviews that both novice and advanced traders can find value here.

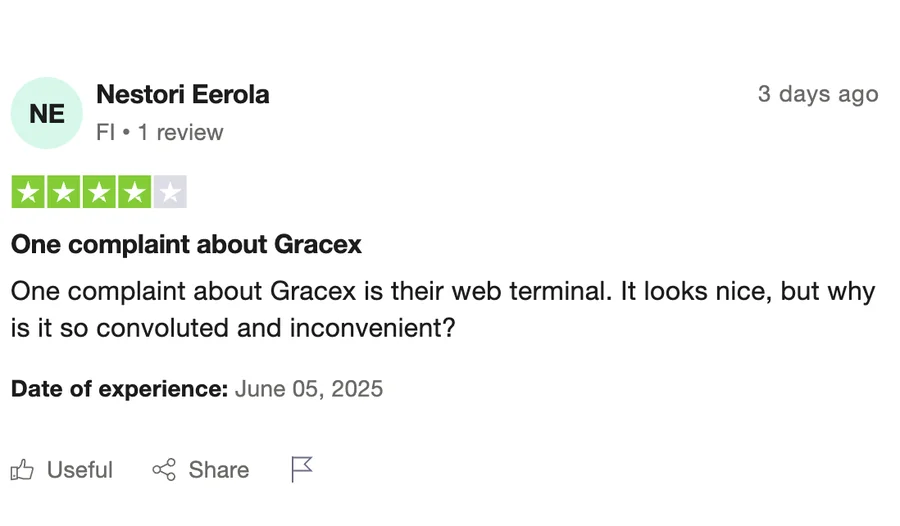

Reputation Breakdown

Based on multiple sources (finance forums, industry reports, user feedback), recurring strengths include:

- Low-cost execution

- Variety of instruments

- Responsive customer support

- WebTrader and MT5 flexibility

Recurring weaknesses noted are minor: limited brand recognition in some regions and regulation by a less prominent licensing authority. Overall, the sentiment aligns with the insights I gathered for this Gracex reviews article.

Final Verdict: Is Gracex Worth It?

Does Gracex live up to the promise in “Gracex Reviews: My Personal Experience with the Broker”? Yes, with caveats. Its modern platform, diverse accounts, automation tools, and transparent fees make it highly competitive. Traders should consider the licensing jurisdiction and ensure it aligns with personal regulatory comfort levels.

Checklist: How to Approach GracexFX

- Choose an account type matching your experience and risk tolerance (FREE, ZERO, FIX, CENT).

- Test WebTrader for browser-based trading convenience.

- Explore Copy Trading or PAMM accounts if you prefer automated or managed strategies.

- Use MT5 for advanced charting and algorithmic trading.

- Track spreads, execution times, and fees for your preferred instruments.

- Engage with educational resources to improve strategy performance.

By following these steps, traders can make a well-informed decision, confirming or contesting their expectations from my Gracex reviews.