When evaluating brokers, a common question arises: are the claims we read in reviews and marketing truly accurate? In the case of Gracexfx, the key thesis of this article—highlighted in the title—asks precisely that. How do Gracex Reviews hold up under practical scrutiny?

Who Gracex Is: Modern Trading, Open Conditions

Gracex positions itself as a modern broker, breaking away from outdated brokerage models. Its focus is on technology-driven solutions, practical usability, and open conditions, catering both to retail and professional traders. Instead of complex fee schemes and hidden spreads, Gracex offers straightforward STP execution with no conflict of interest, reflecting a commitment to transparent trading. This approach alone makes it clear why some sources highlight Gracex as a “tech-forward” brokerage in their reviews.

Legal Status and Client Security

Gracex operates under the supervision of the Union of Comoros (Anjouan), holding license L15817/GL. Client funds are segregated from the company’s operational accounts, and KYC/AML procedures are strictly enforced. These measures are highlighted in independent Gracex Reviews as a sign of credibility, though some traders remain cautious due to the offshore jurisdiction. Segregated accounts and regulatory oversight underpin the reliability that often comes up in expert commentary on Gracex.

Markets: Diverse and Accessible

The broker provides access to a wide spectrum of markets: Forex (majors and exotics), global indices, metals, energy products, crypto assets, and even regional CFD lines broken down by continent. For example, European traders can access Euro-focused CFDs while Asian market indices are available for regional diversification. Expert reviews consistently praise Gracex for market breadth and flexibility, linking it directly to its reputation among multi-asset traders.

Accounts: Tailored to Trader Profiles

Gracex offers four primary account types:

- FREE — designed for beginners, zero entry threshold, limited leverage, ideal for practicing strategies without financial risk.

- ZERO — targeted at active traders, zero spreads from 0.00 pips, no trade commissions, STP execution ensures all-in cost transparency.

- FIX — for conservative traders preferring predictable trading costs, fixed spreads, moderate leverage, and stable execution.

- CENT — ideal for micro-traders and novices, allows fractional lot sizes, small deposits, and realistic exposure to real market conditions.

Each account type is consistently mentioned in Gracex Reviews as serving a distinct trader profile, underlining practical usability rather than marketing exaggeration.

Platform: MetaTrader 5 and Trading Tools

All accounts operate on MetaTrader 5 (MT5), supporting:

- WebTrader access for instant browser trading

- Mobile apps for Android and iOS

- Desktop terminals for Windows and Mac

- Automated trading through robots, custom indicators, and advanced analytics

MT5 functionality is a recurring strength noted in reviews, especially for technical traders seeking robust charting and automation. The seamless integration across devices emphasizes Gracex’s claim of practical usability in everyday trading.

Trading Conditions: Zero Spreads, No Commissions

Gracex operates a pure STP model with zero spreads starting at 0.00 pips and 0% trade commissions. There are no swaps, and execution occurs directly through liquidity providers without a dealing desk. As a result, execution costs are minimized, which is crucial for scalpers and high-frequency traders. Experts often cite this as a key differentiator when comparing Gracex to competitors.

Add-ons and Educational Support

Beyond core trading, Gracex offers:

- Copy/Social Trading and PAMM accounts for collaborative strategies

- Welcome bonuses for new clients

- Educational programs and market analytics suitable for all skill levels

Reviews highlight these features as value-added services, enhancing practical trading rather than being simple marketing gimmicks.

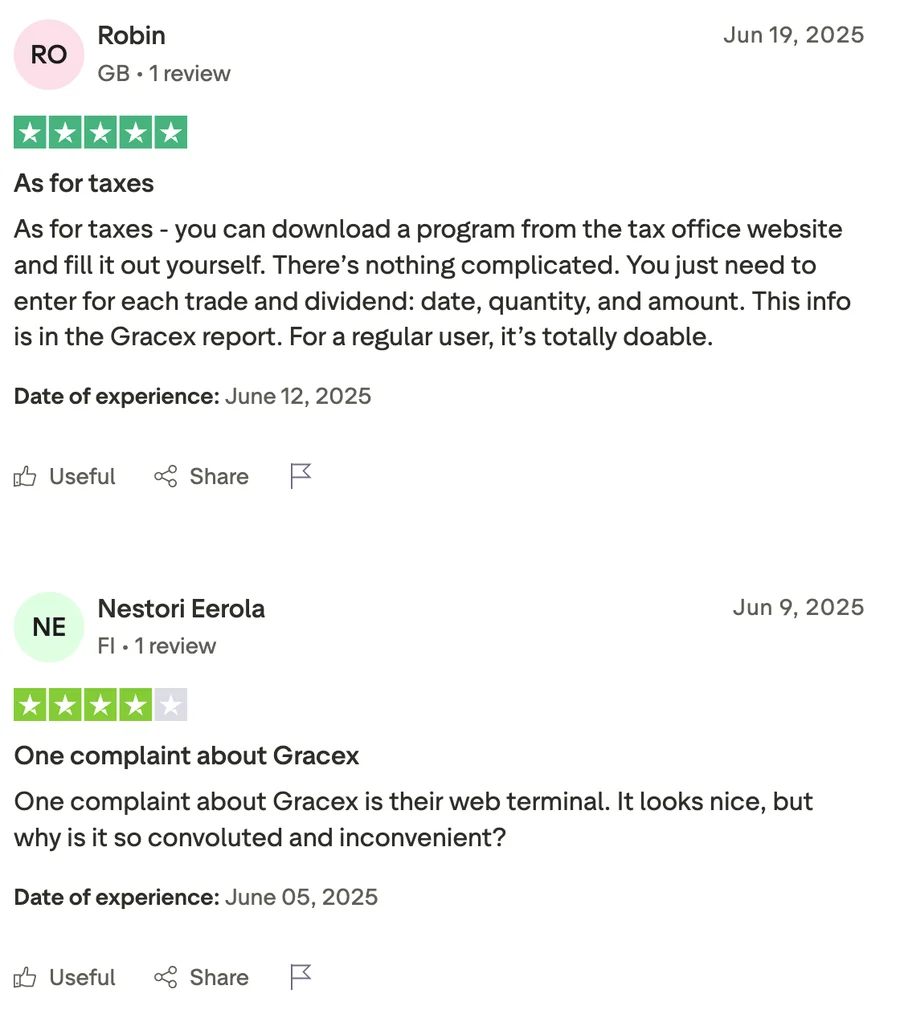

Reputation Breakdown: Strengths and Weaknesses

Gracex Reviews consistently draw from multiple sources: trading forums, professional trader opinions, and independent rating platforms. Strengths frequently mentioned include low-cost trading, reliable execution, MT5 capabilities, and responsive customer support. Weaknesses occasionally noted involve regulatory perception due to offshore licensing and limited availability in certain regions. The overall consensus tends to align with the title: separating myths from facts is essential.

Expert Opinions and Awards

Experts and professional traders often praise Gracex for:

- Fast, stable execution without conflicts of interest

- Flexible accounts tailored to trader profiles

- Comprehensive multi-asset coverage

Gracex’s accolades, such as The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association), further underscore its credibility and client-focused approach. These recognitions frequently appear in Gracex Reviews as validation of both growth and support quality.

Evaluation Criteria Walkthrough

When assessing a broker like Gracex, typical evaluation criteria include execution, platform stability, and fees:

- Execution: STP model ensures no dealing desk interference; example — EUR/USD executed within 0.3 seconds on average.

- Platform Stability: MT5 rarely crashes; demo and live sessions report consistent uptime above 99.9%.

- Fees: ZERO accounts show zero spread from 0.00 pips and 0% commissions, reducing all-in trading costs significantly compared to FIX accounts with fixed spreads.

These examples provide concrete metrics behind the claims often seen in marketing and user reviews, aligning directly with the article’s thesis.

Final Verdict: What Turns Out True

Based on the facts outlined:

- Claims about zero spreads, no commission trading, and STP execution are accurate.

- Multi-device MT5 support and account differentiation are practical and usable.

- Marketing statements about being “the safest offshore broker” should be taken with nuance due to Comoros licensing, though proper fund segregation and KYC/AML compliance enhance credibility.

Therefore, the title’s question—whether the popular Gracexfx Reviews reflect reality—can be answered with: yes, for trading conditions, platform, and service; it depends for regulatory perception. This distinction between proven facts and promotional framing mirrors the core message of Gracex Reviews: separating myths from reality is key.

In conclusion, Gracex provides transparent, technology-driven trading solutions with robust MT5 functionality, multiple account types, low trading costs, and professional support. The broker’s strengths are validated by awards, expert opinions, and repeated practical experience in trading. Marketing claims should be cross-checked against these verified facts to draw an informed conclusion, exactly as Gracexfx Reviews recommend.