The popularity of Gracex as a broker is a topic frequently discussed in the trading community. Gracex Reviews often highlight its technological edge and client-centered approach, but how is this proven in practice? In this article, we dissect the broker’s services, platforms, accounts, instruments, and reputation, providing a full picture for potential traders.

Licensing and Regulatory Compliance

Gracex is regulated by the Union of Comoros (Anjouan) under license number L15817/GL. This regulatory status ensures that client funds are held securely in segregated accounts and that international compliance standards are observed. Traders can expect transparency in operations, risk management practices, and reporting. In other words, Gracex Reviews frequently praise the broker’s emphasis on safety and adherence to global financial norms.

Trading Platforms and Technology

Gracex provides access to MetaTrader 5 across multiple formats: WebTrader, desktop applications for Windows and Mac, and mobile apps for Android and iOS. This broad coverage allows traders to monitor markets, place trades, and manage portfolios on the go. The MT5 environment supports automated trading via robots, custom indicators, and advanced analytics, reflecting the broker’s tech-driven positioning. Many Gracex Reviews highlight this flexibility as a key factor in the broker’s popularity.

Execution Model and Key Metrics

The broker operates a pure STP (Straight Through Processing) model with no dealing desk, meaning there is zero conflict of interest between client and broker. Trade execution is fast and transparent, with spreads starting from 0.00 pips, no trade commissions, and no swap fees. For traders evaluating brokers based on execution and cost-efficiency, these metrics are consistently cited in Gracex Reviews as strengths.

Instruments and Market Coverage

Gracex offers a wide range of instruments, including Forex majors and exotics, indices, metals, energy commodities, cryptocurrencies, and regional CFDs covering Asia, Europe, the US, and Russia. This breadth allows both retail and professional traders to diversify strategies and access multiple markets from a single account. The diverse instrument lineup is another recurring positive in Gracex Reviews.

Account Types and Structure

The broker provides four main account types to suit varying trader needs:

- FREE Account: $0–$500, ideal for beginners or testing strategies; no commission.

- ZERO Account: Minimum $100/month, designed for low-cost trading with minimal spreads.

- FIX Account: Spreads from 3 points, fixed fee per lot; suitable for traders who prefer predictable costs.

- CENT Account: Minimum $10 per lot, allowing small-scale trading and micro-position testing.

Gracex Reviews often note the flexibility of these accounts, particularly for scaling trading activity from beginner to advanced levels.

Add-Ons and Trader Support

Gracex enhances its core offering with multiple value-added services:

- Copy Trading and Social Trading for those who prefer following experienced traders.

- PAMM accounts to allow fund managers to trade pooled client funds transparently.

- Educational resources, including webinars, tutorials, and market analysis.

- Market analytics suitable for traders of all skill levels.

- Welcome bonuses to incentivize new account holders.

These add-ons are frequently cited in Gracex Reviews as evidence of the broker’s customer-oriented philosophy.

Awards and Industry Recognition

Gracex has been recognized with notable industry awards, including The Fastest Growing Broker 2024 by the World Financial Award and The Best Customer Support 2024 by the Forex Brokers Association. Such recognition serves as an external validation of the broker’s operational quality and client focus.

Reputation Breakdown

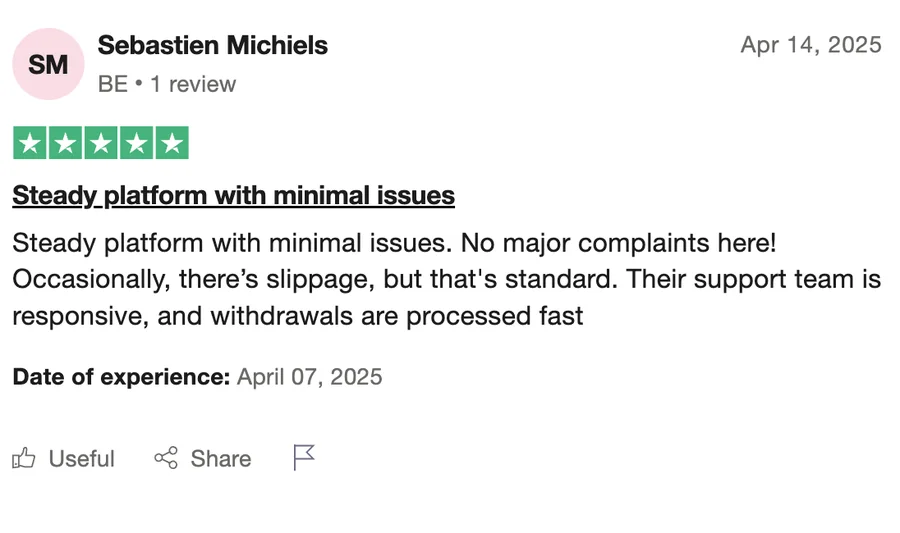

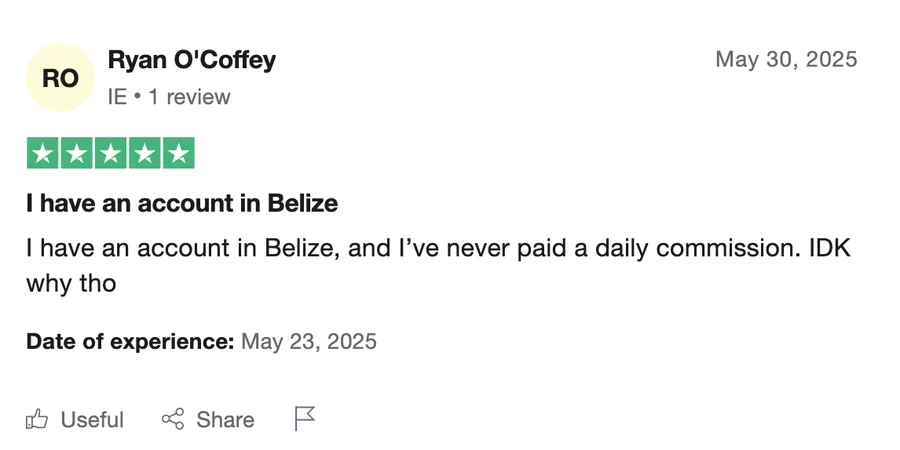

Gracex Reviews sourced from multiple trading forums, social media groups, and review aggregators consistently highlight several strengths and occasional weaknesses:

- Strengths: transparency, low fees, rapid execution, broad instrument selection, robust platforms, and quality customer support.

- Weaknesses: regulatory licensing from a smaller jurisdiction (Union of Comoros) is sometimes flagged as a concern, and advanced instruments may have limited liquidity outside peak hours.

Overall, the reputation is predominantly positive, aligning with the claims in the article title.

Evaluation Criteria in Practice

When assessing Gracex, traders often consider execution speed, platform stability, fees, and account variety:

- Execution: Pure STP model ensures trades are filled without interference, reducing slippage.

- Stability: MT5 WebTrader and apps provide reliable performance, suitable for both desktop and mobile environments.

- Fees: Spreads from 0.00 pips and 0% commissions minimize costs for high-volume traders.

- Account Options: Flexible accounts allow stepwise scaling from beginners to professionals.

These evaluation points echo what Gracex Reviews describe as the broker’s core competitive advantages.

Final Verdict

So, is it true that Gracex is a popular broker? Based on practical metrics, account flexibility, technological infrastructure, and positive user feedback, the answer is: Yes, it is deservedly recognized in its niche. However, prospective traders should consider regulatory jurisdiction and ensure they understand instrument liquidity conditions.

Checklist for Traders Considering Gracex

- Verify account type that aligns with your trading size and strategy.

- Familiarize yourself with MT5 features: automated trading, indicators, and analytics.

- Assess spreads and execution on demo accounts before committing real funds.

- Use educational resources to enhance strategy development.

- Check latest reviews and community feedback for updates on reliability and support.

By following this structured overview, traders can confidently gauge what makes Gracex a popular broker, reflecting the insights provided in Gracex Reviews.